Our attractive investor proposition delivers value through cycles.

At Aramco we invest in growth and innovate for greater sustainability, unlocking new and untapped opportunities.

All of which has helped us attain and maintain our position as one of the world’s highest-earning companies since our initial public offering in 2019.

Reasons to invest with us

From our virtually unparalleled operational scale, to our full control of our closely-integrated Upstream assets, we have a wide range of competitive advantages that set us apart.

“We continue to deliver on our strategy by growing our existing core business as well as expanding into new geographies and working to develop new businesses such as carbon capture and storage, synthetic fuels, blue hydrogen technologies, renewables, and offsets.”

Amin H. Nasser, Aramco President & CEO

Our sustained competitive advantages

These include:

- Favorable geology

- Economies of scale

- Sole Upstream control

- Long-term focus

- Deployment of technology

- Flexibility from spare capacity

Aramco continues to demonstrate our strong operational flexibility and supply reliability by delivering crude and other products in a timely manner.

Reliability

Delivery obligations fulfilled within 24 hrs

99.7%

2024

Low-cost operations

Our low lifting costs and capital expenditures per barrel of oil equivalent produced1 stems from the nature of the Kingdom’s geological formations, the location of our reservoirs in favorable onshore and offshore environments, and our access to a large infrastructure and logistics network, all enhanced by the scaled application of technology2.

Strategy in action

Leadership in technology

Sustainable growth

World-scale refining and chemicals production capacity

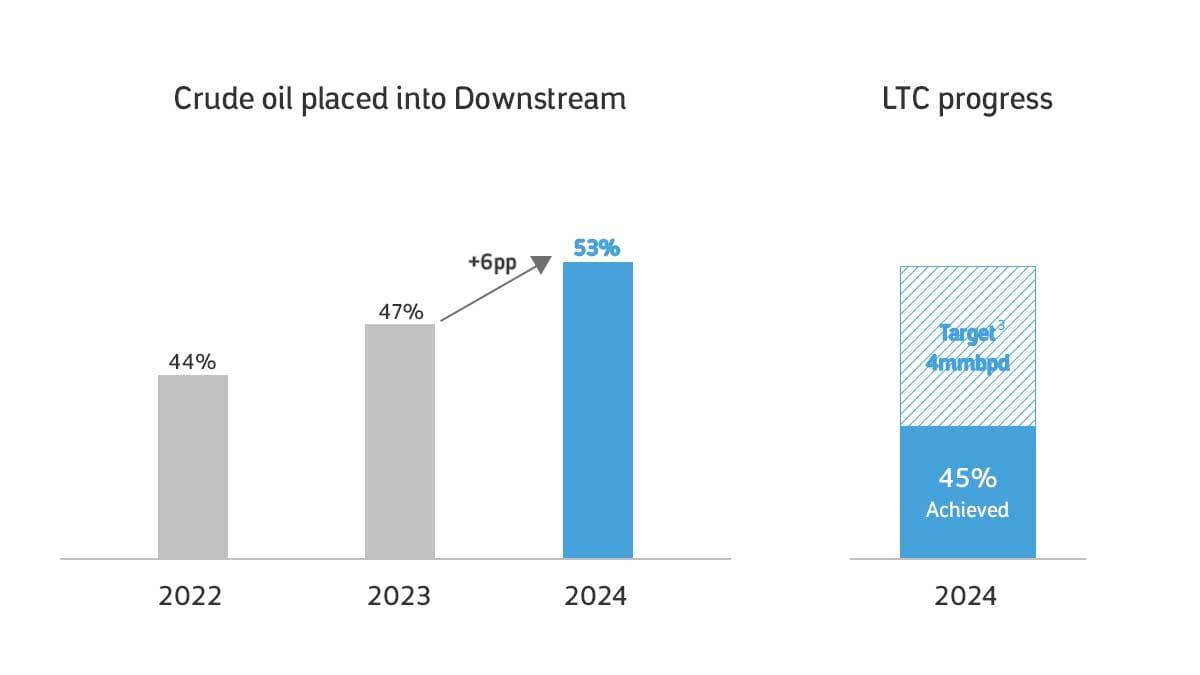

Aramco has a dedicated system of domestic and international, wholly-owned and affiliated refineries. These, along with our petrochemcial complexes, form a growing global network that enables us to capture additional value.

Lower-carbon initiatives

Large-scale decarbonization

Part of being a sustainable business in 2025 requires the adoption and implementation of a clear emissions reduction strategy. This is why Aramco have stated our ambition to attain Net-zero Scope 1 and Scope 2 greenhouse gas emissions across our wholly-owned operated assets by 2050.

Supply chain resilience

Increasing the localization of our supply chain

70%

2025 target for local content

Well-positioned for the Energy Transition

We believe Aramco is well-positioned to actively participate in addressing the world’s growing need for affordable and reliable energy7.

We are providing continued investment to help meet this future market demand.

Our corporate strategy supports energy security and affordability, and promotes sustainable practices in support of an orderly and balanced Energy Transition.

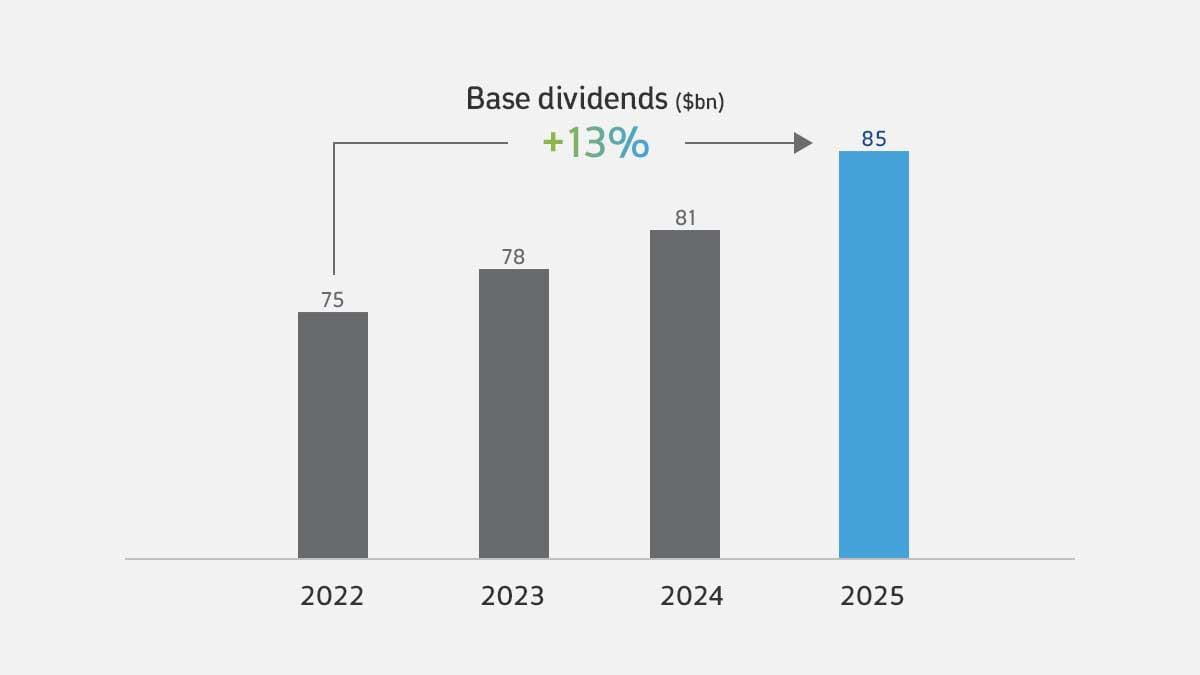

Our enhanced distributions

The price of shares and the income derived from them can go down as well as up and investors may not get back the amount originally invested. Investors should be aware that past performance is not necessarily a guide to future performance. An investment in Saudi Aramco shares may not be suitable for all investors. You should take independent financial advice before making any investment decision.

Footnotes

1. ‘Low-cost’ refers to our low lifting cost and capital expenditures per barrel of oil equivalent produced, based on our 2023 reported figures

2. Refers to Aramco’s Digital Transformation program — learn more about it here

3. Target to increase capacity in petrochemical producing complexes to up to 4mmbpd by 2030

4. The reduction in gross refining capacity was due to termination of Idemitsu Kosan’s Yamaguchi refinery operations in 2024

5. Excludes SABIC Agri-Nutrients business for 2024 and SABIC Agri-Nutrients and Metals (Hadeed) businesses for 2023 and includes only ZPC’s net chemical production capacity through our investment in Rongsheng

6. The reduction in net chemicals production capacity is due to the termination of operations of three assets related to SABIC mainly in Europe

7. Based on IEA World Energy Outlook 2022: Total primary energy demand in IEA NZE Scenario — outlook-for-energy-demand

8. Dividends are subject to the Board’s discretion and declared in accordance with the dividend distribution policy