Q1 net income remains robust and growth strategy on track as Downstream expansion progresses

- Net income: $31.9 billion (Q1 2022: $39.5 billion)

- Cash flow from operating activities: $39.6 billion (Q1 2022: $38.2 billion)

- Free cash flow1: $30.9 billion (Q1 2022: $30.6 billion)

- Gearing ratio1: -10.3% as at March 31, 2023, compared to -7.9% at end of 2022

- Q4 2022 dividend of $19.5 billion paid in the first quarter; representing a 4.0% increase on the previous quarter

- Q1 2023 dividend of $19.5 billion to be paid in the second quarter

- Intention to introduce a mechanism for performance-linked dividends, in addition to the base dividend

- Extraordinary General Assembly approves bonus shares grant of one bonus share for every 10 shares held

- Major investments advance strategic downstream expansion in key global markets

- iktva signings valued at around $7.2 billion expected to further strengthen supply chain efficiency

- Agreement with Linde Engineering for the development of a new ammonia cracking technology, which supports the advancement of lower-carbon energy solutions

Commenting on the results Aramco President & CEO Amin H. Nasser, said:

“The results reflect Aramco's continued high reliability, focus on cost and our ability to react to market conditions, as we generate strong cash flows and further strengthen the balance sheet. Reinforcing our commitment to maximize long-term shareholder value, we are also announcing our intention to introduce a mechanism for performance-linked dividends, in addition to the base dividend the Company currently distributes.

“Our growth strategy remains on track and we made significant progress on the strategic expansion of our Downstream business during the quarter, announcing a key acquisition in the US as well as important investments and partnerships in China and South Korea. Our global Downstream strategy is gaining momentum, and we are leveraging cutting-edge technologies to increase our liquids-to-chemicals capacity and meet anticipated demand for petrochemical products.

“We are also moving forward with our capacity expansion, and our long-term outlook remains unchanged as we believe oil and gas will remain critical components of the global energy mix for the foreseeable future.

“Our intention is to continue to be a reliable energy supplier with the ability to provide more sustainable energy solutions, supporting efforts to achieve an orderly energy transition. By working to further reduce the carbon footprint of our operations, and adding new lower-carbon energy options to our portfolio, I am confident about the contributions we will make.”

For more information, please see the 2023 Saudi Aramco First Quarter Interim Report.

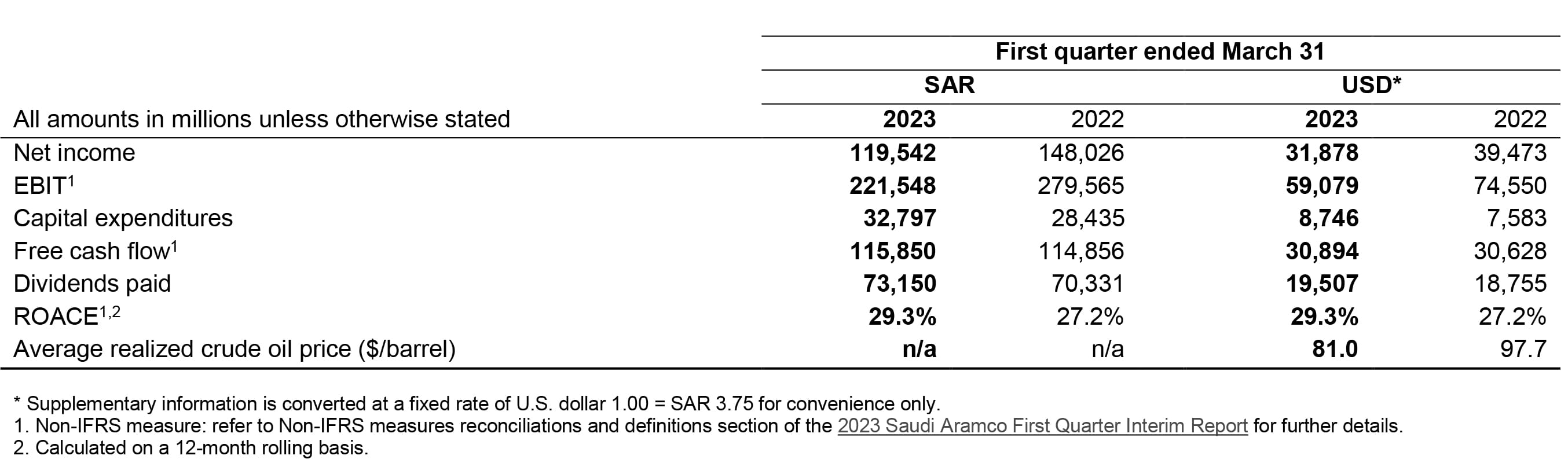

Key financial results

|

First quarter ended March 31 |

|||||||

|

SAR |

USD* |

||||||

|

All amounts in millions unless otherwise stated |

2023 |

2022 |

2023 |

2022 |

|||

|

Net income |

119,542 |

148,026 |

31,878 |

39,473 |

|||

|

EBIT |

221,548 |

279,565 |

59,079 |

74,550 |

|||

|

Capital expenditures |

32,797 |

28,435 |

8,746 |

7,583 |

|||

|

Free cash flow |

115,850 |

114,856 |

30,894 |

30,628 |

|||

|

Dividends paid |

73,150 |

70,331 |

19,507 |

18,755 |

|||

|

ROACE1,2 |

29.3% |

27.2% |

29.3% |

27.2% |

|||

|

Average realized crude oil price ($/barrel) |

n/a |

n/a |

81.0 |

97.7 |

|||

* Supplementary information is converted at a fixed rate of U.S. dollar 1.00 = SAR 3.75 for convenience only.

1. Non-IFRS measure: refer to Non-IFRS measures reconciliations and definitions section of the 2023 Saudi Aramco First Quarter Interim Report.

2. Calculated on a 12-month rolling basis.

Key financial results

Media contact information

All media enquiries are handled by Aramco’s Media Communications & Coordination Department, Dhahran, Saudi Arabia.

For media inquiries, please email us at media.inquiries@aramco.com