Aramco Sustainability report 2024

Climate change and the energy transition

2024 performance

- Total Scope 1 and Scope 2 emissions (market-based) rose by 1.8% and upstream carbon intensity increased by 1.0%, due to higher gas production to support the Kingdom’s growing domestic demand.

- Our upstream methane emissions decreased by 11.4% and our upstream methane intensity decreased by 0.01 percentage point (p.p.).

- To complement our net-zero ambition, and as a signatory to the Oil & Gas Decarbonization Charter (OGDC), we have a new interim target to achieve an upstream carbon intensity of 8.6 kg CO2e/boe by 2030.

- Completed five third party verified carbon offset crude cargo shipments with an average carbon intensity of 7.48 kg** CO2e/boe.

- Our $1.5 billion Sustainability Fund invested $107 million*, bringing our cumulative investment to $500 million across 36 portfolio companies to date.

- Procured 1.1 million tons of carbon credits and retired 0.51 MMtCO2e credits to offset our corporate emissions.

- Energy intensity increased by 5.9% compared to 2023, primarily due to higher energy consumption, driven by downstream operations, and expansion of gas operations and compression activities.

Scope 1 emissions (MMtCO2e)

(2023: 54.4**)

56.1**

Scope 2 emissions (MMtCO2e)

(2023: 13.0**)

12.4**

Upstream carbon intensity - Market based (kg CO2e/boe)

(2023: 9.6**)

9.7**

Upstream methane intensity (%)

(2023: 0.05)

0.04**

Flaring intensity (scf/boe)1

(2023: 5.64**)

6.07**

Energy intensity1(thousand Btu/boe)

(2023: 153.8)

162.9

** This figure has undergone external limited assurance in accordance to the ISAE 3000 (revised). The assurance report can be found on Our data and assurance page.

1. This metric is not applicable to our office-based entities: ATC, AACO, AOC, and SAAC.

Aramco completes five verified carbon offset crude cargo shipments

Building on the success of the 2023 pilot project to deliver the first verified carbon offset crude cargo, in 2024, we have progressed on this strategic capability to deliver Arabian Light with five additional verified carbon offset crude oil cargo shipments from our Ras Tanura and Juaymah terminals.

Using a cradle-to-gate life-cycle assessment, third-party verified product-level carbon emissions, and implementing GHG emissions reduction initiatives with the optional use of offsets for residual emissions, demonstrates the Company’s capability to deliver lower-emissions products.

The average carbon intensity of the five shipments was 7.48** kg CO2e/boe of which the production and loading stages were 2.95** kg CO2e/boe for the Ras Tanura terminal, and 2.56** kg CO2e/boe for the Juaymah terminal, with the remaining emissions attributed to shipping. The total volume of Arabian Light crude oil shipments is 10 million bbl (five cargos of two million bbl each).

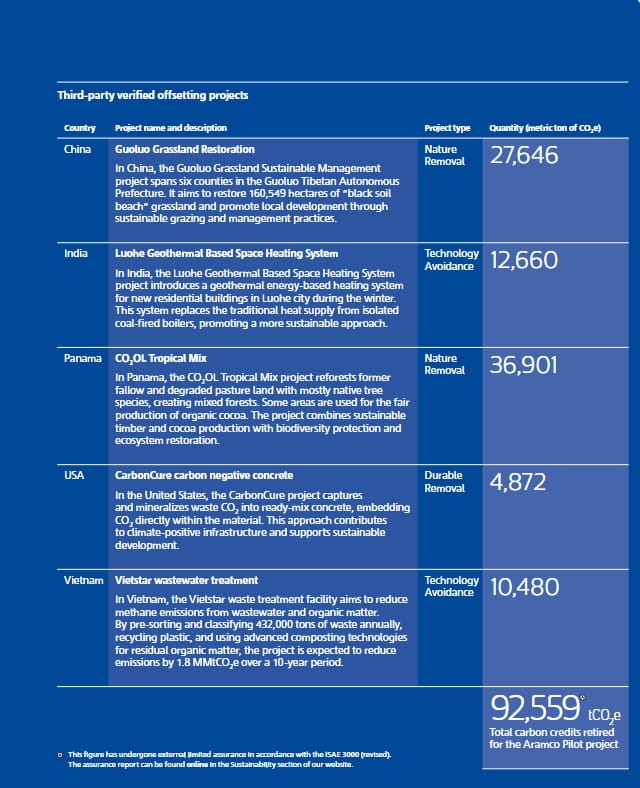

After implementing GHG emissions reduction initiatives in Arabian Light crude production facilities, Aramco retired carbon credits purchased from the VCM2 to offset residual emissions.

A total of 92,559** tCO2e carbon credits were offset to counter the pilot shipment’s residual emissions. Of these offsets, 75% originated from carbon removal projects, while 25% came from carbon avoidance projects, all issued by Verra and Gold Standard. Independent rating agencies rated these projects BB or higher, showcasing our efforts in financing valuable offset projects and reducing GHG emissions. Lloyds Register Quality Assurance (LRQA) conducted third-party verification, and the Qualifying Explanatory Statement is available online. The carbon credits were sourced from the Saudi Voluntary Carbon Market with projects spanning various scopes and types across regions ranging from North America to Asia.

The next entity in the value chain of this pilot, Motiva’s Port Arthur Manufacturing Complex, made progress in their measurement of the product-level emissions of their base oils production by undergoing third-party verification against ISO 14067. This pilot project reaffirms Aramco’s efforts to deliver third-party verified lower-carbon products.

Average carbon intensity of the five shipments

7.48**kg CO2e/boe

Average carbon intensity for production and loading stage for Ras Tanura terminal

2.95**kg CO2e/boe

Average carbon intensity for production and loading stage for Juaymah terminal

2.56**kg CO2e/boe

Total carbon credits retired for Aramco Pilot project

92,559** tCO2e